RoDTEP ( Remission of Duties and Taxes on Export Products )

RoDTEP, or Remission of Duties and Taxes on Export Products, is an acronym. It went into effect on January 1, 2021, replacing the previous MEIS (Merchandise Exports from India Scheme). Getting refunds for embedded taxes and levies that were previously non-recoverable is the main goal of RoDTEP for exporters.

How Does RoDTEP Work?

- Tax Rebates: Exporters that are not exempt or refunded under any other scheme may be eligible for reimbursements via the RoDTEP on taxes and tariffs. This covers both state and federal taxes.

- Embedded Taxes: Exporters’ embedded taxes and levies on their goods are the focus of this scheme. In the past, these were never reimbursed or rebated.

- Increasing Exports: The goal of RoDTEP is to increase the export of items whose volume had previously lagged by making exports more competitive.

Important RoDTEP Features:

- Extensive Coverage: RoDTEP guarantees inclusivity across industries by covering a broad spectrum of export items.

Transparent Rates: Exporters can more easily assess their benefits thanks to the scheme’s explicit rates for various product categories. - Sector-Specific Extensions: RoDTEP’s influence has been expanded by recent notifications that have expanded it to new sectors.

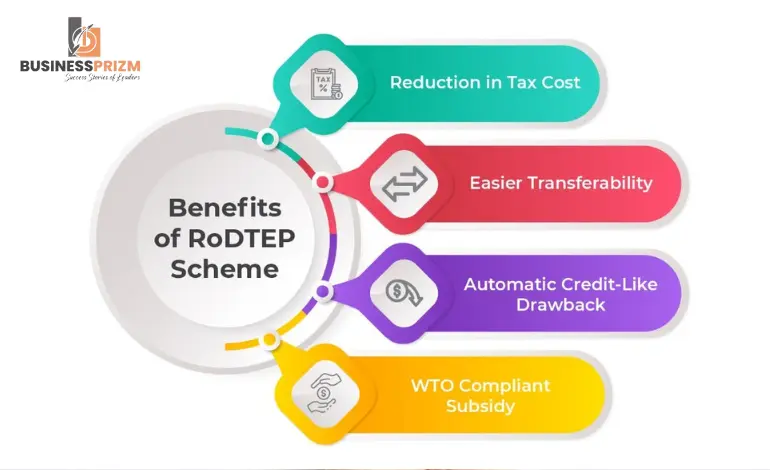

Gains for Exporters

- Financial Relief: By helping exporters recoup their tax and duty expenses, RoDTEP reimbursements increase their profitability.

- Competitiveness: RoDTEP increases the competitiveness of Indian products in the international market by lowering the tax burden.

- Promoting Diversification: By providing incentives to formerly marginalised industries, the programme promotes export diversification.

In summary, the RoDTEP programme is an important step in supporting India’s export industry. It strengthens exporters and advances the economic expansion of the country by returning embedded taxes and customs. The impact of the plan on India’s international trade will be continuously observed as it develops.