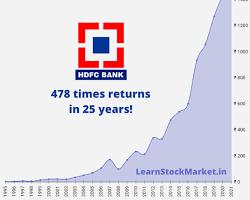

In the bustling world of finance, certain keywords capture the attention of investors and analysts alike, shaping the day’s discourse in stock markets. Recently, “HDFC Bank Share” has emerged as a trending keyword, signaling an uptick in discussions surrounding one of India’s premier banking entities. This blog delves into the latest news and updates concerning HDFC Bank shares, offering insights into why it’s commanding the spotlight.

The Surge in Interest

HDFC Bank, a behemoth in the Indian banking sector, has always been a focal point for investors owing to its robust performance, strategic growth initiatives, and resilient business model. The bank’s shares have been trending for a variety of reasons, ranging from quarterly financial results to strategic mergers, acquisitions, and more. Let’s explore the factors contributing to the current interest.

Latest Financial Performance

The bank’s latest quarterly results have likely fueled the burgeoning interest in its shares. Investors closely monitor these results for insights into the bank’s operational efficiency, profitability, asset quality, and growth trajectory. Any significant deviations, whether positive or negative, can greatly impact the market’s perception and, consequently, the stock’s performance.

Strategic Moves and Regulatory Updates

Another contributor to the trending status of HDFC Bank shares might be its strategic maneuvers, including expansions, mergers, and acquisitions. Such initiatives can significantly influence investor sentiment, as they often hint at the bank’s future growth prospects and market expansion plans. Additionally, regulatory changes affecting the banking sector, or HDFC Bank specifically, could also be driving the heightened interest, as these can have direct implications on the bank’s operations and profitability.

Market Sentiment and Economic Indicators

Market sentiment, influenced by broader economic indicators such as inflation, interest rates, and GDP growth, plays a crucial role in the performance of banking stocks like HDFC Bank. Positive economic forecasts can buoy banking stocks, while uncertainty or negative indicators can apply downward pressure. The current trend might reflect market sentiment responding to recent economic developments affecting the banking sector.

Future Outlook

The future outlook for HDFC Bank is a matter of keen interest for both individual and institutional investors. Analysts’ ratings, forecasted growth, and potential market challenges or opportunities can significantly sway investment decisions. The bank’s strategies to navigate the evolving financial landscape, tackle competition, and leverage technology for service enhancements are critical factors that could shape its future performance.

HDFC Bank Shares Surge Amidst Strong Q4 Growth

In a remarkable display of resilience and growth, HDFC Bank’s shares have shown a significant increase, reflecting the bank’s robust performance in the last quarter. The bank’s share price today witnessed a 3.07% rise, showcasing a promising trend for investors and stakeholders alike.

Q4 Performance Highlights

The latest quarterly update reveals that HDFC Bank’s gross advances have soared by an impressive 55% year-on-year (YoY) to ₹24.69 lakh crore. This substantial growth is complemented by a 26% increase in deposits compared to the previous year, indicating a strong financial position and customer trust.

Factors Contributing to the Rise

The surge in HDFC Bank’s share price can be attributed to several key factors:

- A significant year-on-year growth in gross advances to ₹25.08 lakh crore as of March 31, 2024.

- A robust increase in deposits, with retail deposits growing by 27.8% YoY and wholesale deposits by 19.4% YoY.

- The bank’s strategic focus on expanding its retail loan portfolio, which has seen a remarkable 108.9% growth YoY.

Here are some details about HDFC Bank shares as of yesterday, April 4, 2024:

-

- Current Price: ₹1,529.00 (NSE)

- Change: Up 3.15% from the opening price

- Market Cap: ₹11,60,535.10 Cr

- 52 Week Range: ₹1,364.00 – ₹1,758.00

You can find more information about HDFC Bank shares on the National Stock Exchange of India website https://www.nseindia.com/get-quotes/equity?symbol=HDFCBANK or other financial websites.

Market Response

The market has responded positively to HDFC Bank’s strong performance, with the share price gaining almost 3% following the announcement of the Q4 results. This uptick is a testament to the bank’s consistent focus on growth and stability, even amidst challenging economic conditions.

Looking Ahead

The trending status of HDFC Bank shares underscores the dynamic nature of the stock market, where multiple factors intersect to influence investor sentiment and market movements. For those interested in investing in HDFC Bank or currently holding its shares, staying abreast of the latest news, financial reports, and market trends is imperative. As one of the leading lights in the Indian banking sector, HDFC Bank continues to attract scrutiny and interest, promising a blend of opportunities and challenges for savvy investors.

As the situation is dynamic, readers are encouraged to consult a variety of sources and, if necessary, financial advisors, to get the most current and comprehensive insights before making investment decisions.

As HDFC Bank continues to navigate the dynamic financial landscape, its recent performance serves as a beacon of optimism for the banking sector. With a clear growth trajectory and a commitment to delivering value, HDFC Bank remains a key player to watch in the times ahead.

This blog post incorporates the latest news and updates on HDFC Bank’s share performance, providing readers with a comprehensive overview of the bank’s current standing and future prospects.