Paytm, the Indian multinational technology company, has been making headlines recently due to its stock performance. Let’s delve into the details and understand what’s been happening with Paytm’s share price.

Recent Stock Performance:

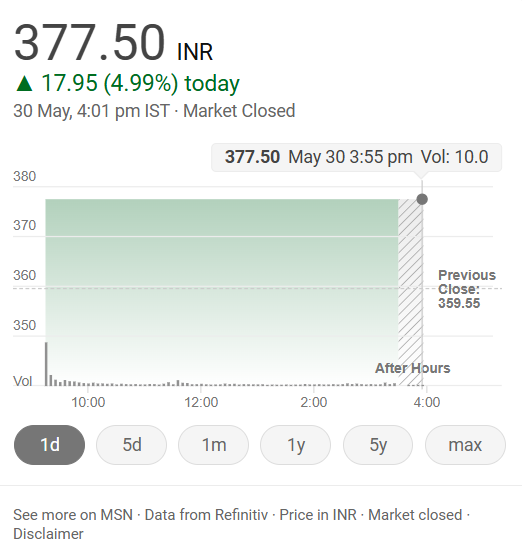

- Closing Price (May 30, 2024): ₹356.55

- Previous Close (May 29, 2024): ₹359.55

- 52-Week High: ₹998.3

- 52-Week Low: ₹310

Financial Snapshot (Fiscal Q4 2024):

- Revenue: ₹22.67 billion (down 2.89% YoY)

- Operating Expense: ₹8.67 billion (up 10.49% YoY)

- Net Income (Loss): ₹-5.50 billion (widened net loss)

- Net Profit Margin: -24.24% (ouch!)

- Earnings per Share: ₹-9.00

- EBITDA: ₹-2.35 billion

- Effective Tax Rate: -2.63%

Market Capitalization:

- As of the last trading day, Paytm’s market cap stood at ₹216.80 billion (INR).

Recent News:

- Despite the widening net loss in Q4, Paytm shares rallied 5%.

- The company’s CEO, Vijay Shekhar Sharma, has been vocal about financial numbers and AI.

Trading Volume:

- On the BSE, the trading volume for Paytm ranged from 135,588 to 168,176 shares on different days.

Paytm’s journey as a publicly listed company has been eventful, and its stock price continues to be closely watched by investors and enthusiasts alike. As the fintech landscape evolves, Paytm’s performance remains a key indicator of market sentiment.

Remember, stock prices can be as unpredictable as a monsoon rain! Always do your due diligence before making investment decisions.